Singapore banks’ earnings momentum is set to lose steam this year amid rising funding costs and a drag from possible rate cuts.

Key highlights from the analysis include:

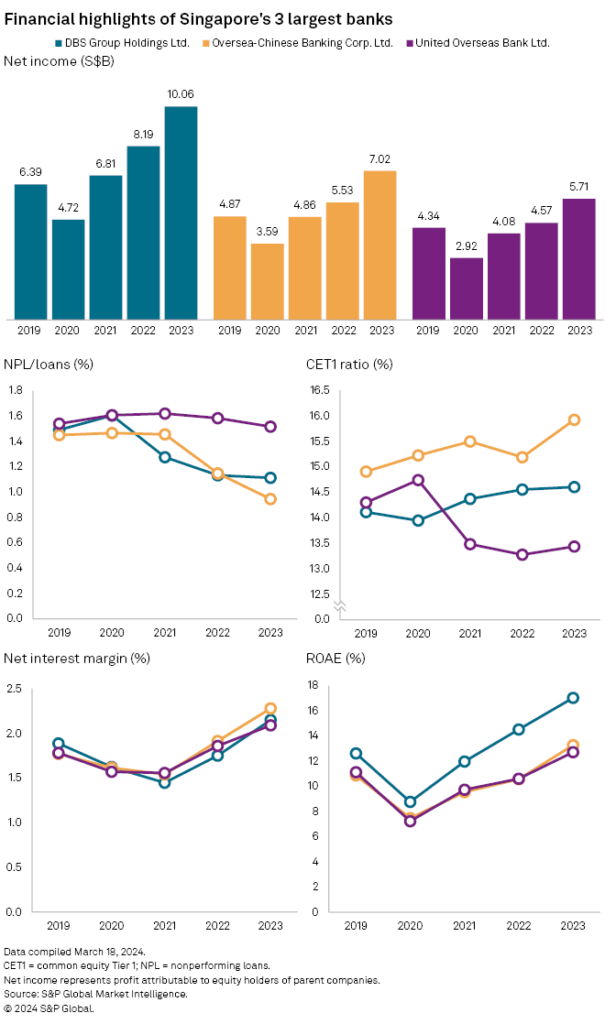

· DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd. (OCBC) and United Overseas Bank Ltd. (UOB) reported solid increases in net profit for the year ended Dec. 31, 2023, primarily due to higher net interest income. DBS, the largest bank in Southeast Asia by total assets, posted a 26% year-on-year (y/y) jump in its 2023 net profit to a record-high S$10.29 billion. OCBC reported net profit of S$7.02 billion, up 27% y/y, while UOB’s net profit rose 25% y/y to S$6.06 billion.

· The city-state’s banks are not likely to repeat the results in 2024, according to analysts’ mean consensus estimates compiled by S&P Global Market Intelligence. Net income at DBS is expected to decline to S$9.94 billion in 2024, while UOB’s net income will drop to S$5.86 billion. OCBC is the only lender likely to buck the trend, with its net income expected to edge up to S$7.12 billion in the period.

· Banks could face earnings pressure after benefiting from higher net interest margins (NIMs), as the US Federal Reserve and other central banks are expected to start cutting rates this year. The Monetary Authority of Singapore uses currency as its primary policy tool due to the dominance of external trade over the country’s economy. It was among the first central banks in Asia-Pacific to initiate monetary tightening in October 2022 to counter rising inflation. The big three Singaporean banks saw healthy NIM improvement in 2023, with DBS showing the biggest movement, to 2.15% from 1.75% in 2022, S&P Global Market Intelligence data shows.

· While DBS’ nonperforming loan (NPL) ratio for 2023 remained unchanged from a year ago, both OCBC and UOB improved their respective NPL ratios, according to S&P Global Market Intelligence data. OCBC’s NPL ratio improved to 1.00% from 1.20%, while UOB’s ratio improved to 1.50% from 1.60 in 2022.

SOURCE: S&P Global Market Intelligence

This analysis was produced by S&P Global Market Intelligence, not S&P Global Ratings, which is a separately managed division of S&P Global. Please attribute any commentary/data you cite from this analysis to S&P Global Market Intelligence.